Social Security Beneficiaries Will Receive Stimulus Check

According to WILX, the Treasury announced in a reversal, that Social Security beneficiaries who typically do not file a tax return will automatically receive the $1,200 payment.

Social Security recipients who are not typically required to file a tax return do not need to take any action, and will receive their payment directly to their bank account.

This is updated from the initial guidance included in the Stimulus Bill where the IRS said everyone needs to file some sort of tax return.

Here are some other key notes of the Stimulus Bill:

1. Tax filers with adjusted gross income up to $75,000 for individuals and up to $150,000 for married couples filing joint returns will receive the full payment.

2. Parents with children who are 16 years old and younger will receive $500 per child.

3. If you are on unemployment assistance, you will get another $600 per week on top of the amount your state already pays. Please click on the above link for more key notes of the Stimulus Bill.

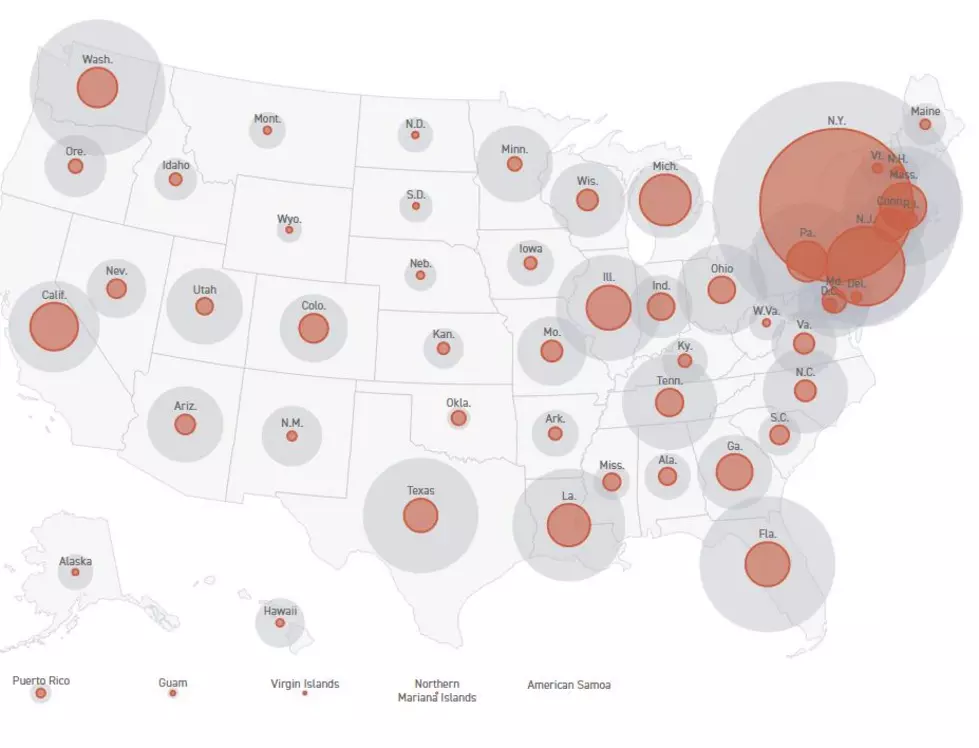

MORE TO EXPLORE: See the the COVID-19 stimulus bill broken down by the numbers

More From 1240 WJIM AM